10 Myths About The Dreaded Inheritance Tax

The inheritance tax debate is all heat and no light. Here are ten common myths that don’t survive contact with reality.

19 April 2015

The Conservative Party’s 2015 manifesto pledges a new inheritance tax relief for main homes, which will effectively raise the tax-free allowance to £1 million. I get the politics, but this is lousy economics: estate duties are more progressive and less distortionary than other taxes, and a new relief will add complexity when we should be simplifying the rules.

(Don’t just take my word for it, here’s the Treasury’s own advice, the analysis from the IFS, Ben Goldacre’s pithy take on things, Irwin Stelzer in the Spectator, Jonathan Eley for the FT, and the view from The Economist.)

Pandering to the inheritance tax lobby is a favourite pastime for our politicians. Back in 2007 George Osborne pledged to raise the tax-free allowance to £1 million. Party members in the audience cried tears of joy, and Gordon Brown didn’t call an early general election.

Perhaps one day we’ll manage to have a sensible discussion about what inheritance tax is for and how it might be reformed. In the meantime, let’s bust some myths!

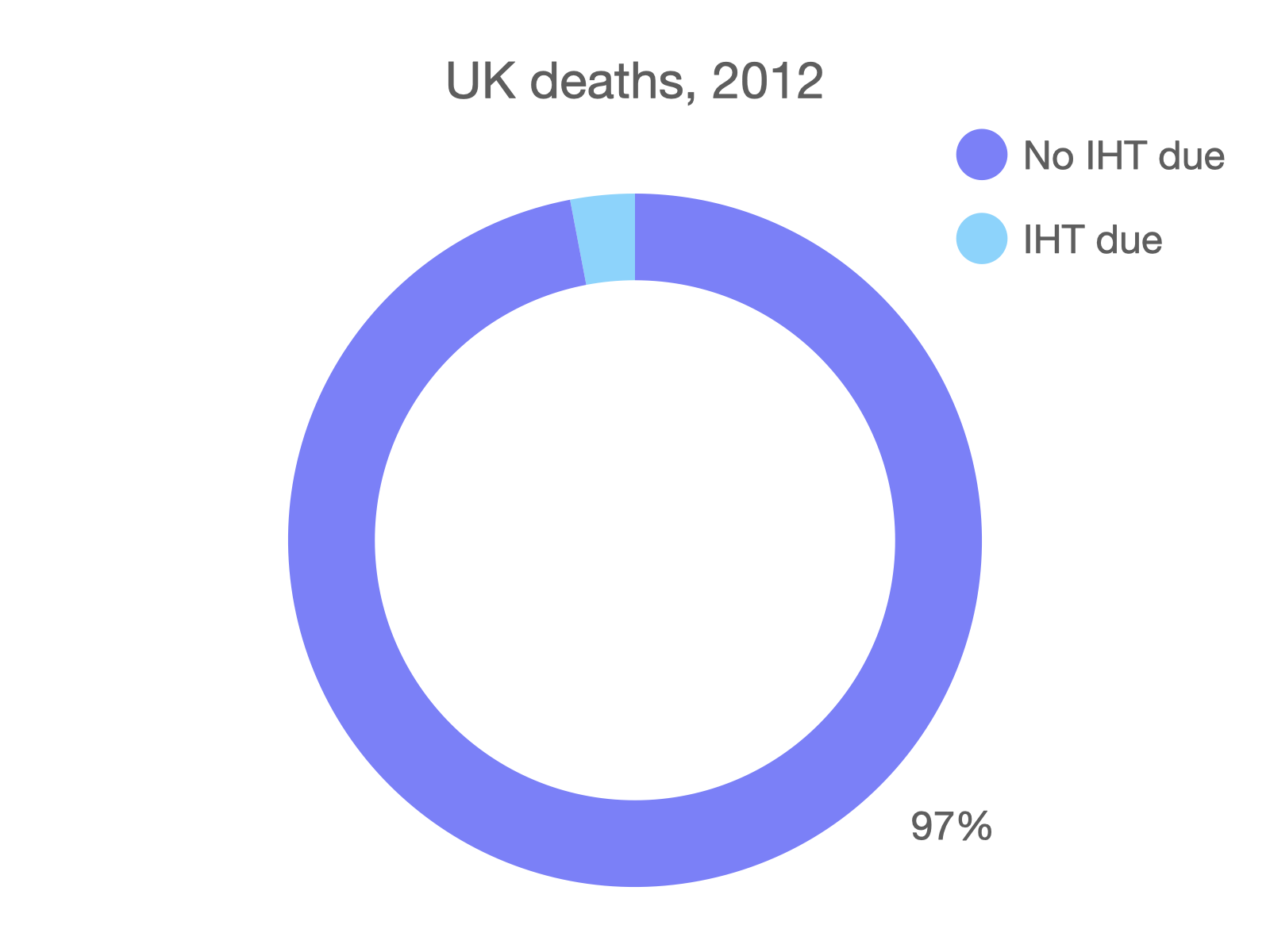

1. It hits average people

The latest official figures say only 3% of estates attracted inheritance tax. Ok, house prices have gone up since those stats were published, so perhaps today’s figure is somewhere between 5% and 10%. And there are special reliefs that help some very wealthy people shield their assets from tax, so the top 1% are probably getting away with blue murder. But even so, if one in ten are average, then what does that make everyone else?

2. It’s double taxation

This is a delicious KFC Double Down, and the Colonel charged me VAT on it even though I already paid income tax on the money in my wallet. I’d call the double tax police, but just think what will happen when they get round to investigating petrol and beer.

3. It’s the ultimate bad luck

You bought your house for tuppence in the year dot and now, through no fault of your own, it’s worth the best part of £1 million? Misfortune just follows you around, doesn’t it.

4. It’s theft

Nope. It’s the law.

5. It throws families out of their homes

Transfers between spouses, including homes of any value, are exempt from inheritance tax. For properties passed down the generations you’d probably expect most to end up being sold anyway, but we could definitely do with much better data on what’s going on.

6. It makes ordinary people pay higher rate tax

Here comes the science bit - concentrate! The rate is indeed 40%, but only on amounts over the tax-free allowance. So a £1 million estate left by a couple, say, would face an effective tax rate of 14% (go ahead and do the maths if you don’t believe me). Having said that, there is still an interesting argument for cutting the rate and broadening the base.

7. It’s ruining family businesses

If anything, it’s the reverse. A special inheritance tax relief is thought by many to contribute to unusually poor management amongst family firms.

8. It’s a tax on inheritances

Trick question: it’s actually a tax on estates. Inheritances are what’s left over after all of an estate’s taxes and debts have been settled. Making it into an actual inheritance tax might not be a bad thing. Or we could switch the name back to estate duty, but that’s probably not a brilliant use of parliamentary time.

9. It hardly raises any money, anyway

Inheritance tax receipts were £3.4 billion in 2013-14. But hey, who needs things like nurses and teachers? They’re so overrated.

10. It’s a tax on love

Come on, we all know money can’t buy you love.

This post is dedicated to all the civil servants at HM Treasury and HM Revenue & Customs who deal patiently and professionally with this highly emotive topic. Remember, children: the government keeps all aspects of the tax system under review.